Quantitative Literacy should be mandatory

Cartoon by Bradley Woodside

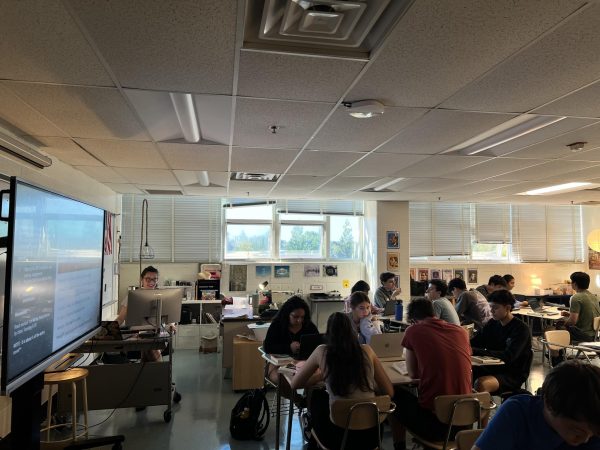

Quantitative Literacy is commonly pushed aside and considered slow. In reality, it’s a practical and useful class.

Feb 8, 2019

A few years back, I told my math tutor that I wanted to take Quantitative Lit (Quant Lit) during my senior year, since I had heard that it’s useful and relatively easy. She chuckled and said that quant lit is “mickey mouse math”. Sure, it’s not a traditional math class where agonizing over formulas and looking for X is standard procedure. It’s better than that. It covers a whole host of important topics, from how taxes work and how to do them, to avoiding debt and planning for retirement. The vast majority of high school students have no idea – or a very vague one at the least – about any of these things by the time they graduate. And that’s not the only problem. There is also somewhat of a stigma associated with Quant Lit, that it’s just an easy A, a filler math credit class for people who’re too lazy for “real” math.

This mindset is not just wrong, but it’s also a real disservice to students everywhere. Without a doubt, Quant Lit should be a mandatory class. It should be right up there with algebra and geometry as a required credit. School is not only here to teach us general knowledge, but to mold and shape us to be functioning members of society. Financial literacy training is imperative to that. Not to say that traditional math isn’t important for some fields, but for the average person, it just doesn’t come up in their day to day life. Spending so many years on seemingly random, abstract concepts such as quadratic equations, trigonometric identities or polynomial functions, just for them to be utterly forgotten, is a waste.

Instead of spending so much time and energy on concepts that apply to a very small percent of the general population, why not teach something that every single person needs in their life and can benefit from? Our society of chronic debt and living paycheck to paycheck demonstrates even further that financial literacy is not emphasized enough in our education system, and that it needs to be.

I’m not going to lie, math was never my strong suit. Throughout the years, math was just another one of life’s obstacles that I needed to get through, a necessary evil. Every day, I would frantically copy notes that I didn’t understand, go through hundreds of youtube tutorials after school in a vain attempt to make sense of those notes, and have the occasional nervous breakdown. During that mess, I would always ponder why I was stuck, year after year, having heart palpitations and losing sleep over things that I knew were trivial in the long run. Why couldn’t I learn something useful for once?

Let me tell you, if you’re anything like me, quant lit is truly a breath of fresh air. You will finally learn the answers to the many questions about money that have been lingering in your mind for so long. You’ll learn vital information such as how to write a resume, avoid credit card debt and manage a bank account. You’ll also learn what the Federal Reserve is and what they do.

Unfortunately, many students never get the chance to take quant lit during their four years at WJ or have ever even heard of the class, which is yet another symptom of the abysmal lack of emphasis on financial literacy training. But students who are about to graduate and enter the real world on their own for the first time will greatly benefit from having the knowledge that quant lit teaches. It will give them the tools that they need to conquer that intimidating, uncertain period in their lives, the same tools that they can continue to use to ensure lifelong success and prosperity.